Startup owners are laser-focused on growing their businesses faster. Productivity and profitability are their primary challenges. Therefore, many promoters go the whole hog at work and also urge their people to follow suit. Startup owners know the importance of addressing their employees’ wants and needs. Therefore, they work closely with the team members and even handhold them whenever they face challenges. In reality, these business owners may not always have the resources to meet all their employees’ expectations.

Payroll Management: A Challenge for Startup Managers

Payroll management is about paying a certain number of employees for their work during a specified period. Though it sounds simple, the calculation of exemptions, deductions, and payouts makes the process complex and time-consuming.

Many startups follow manual and spreadsheet-based processes, resulting in payment delays and computation discrepancies. This can snowball into a bigger problem, resulting in employee demotivation and high turnover rates.

Also, legacy payroll processes and the lack of payroll processing skills could lead to compliance issues and hefty penalties for the business.

Startups Can Count on an Advanced Payroll Software

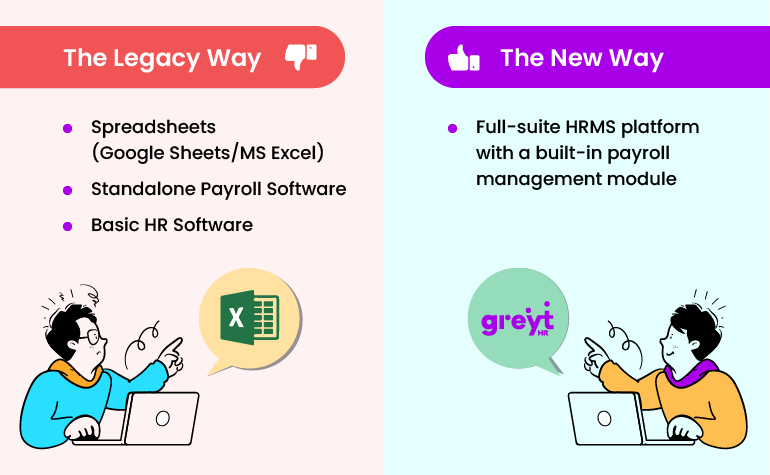

There are multiple ways to handle the payroll function in a startup: with spreadsheets, standalone payroll software, or a basic HR software. Alternatively, they can outsource the work to an external agency offering payroll services. All of these options could have their limitations in terms of cost-efficiency, security, and scalability.

The best option for a fast-emerging startup is a cloud-based, full-suite HRMS with an advanced payroll software. These solutions offer the much-needed flexibility to startups. Unlike the clunky on-premise software solutions, they are easier to maintain, manage, and scale. Moreover, they are more affordable.

An Advanced Payroll Software: Feature-Rich & Future-Ready

An advanced payroll software puts the HR team in control of the entire payroll cycle, not just a couple of stages. There are multiple tasks to be performed by both employers and employees on a monthly and yearly basis. Some of these tasks can be carried out by employees via the self-service portal.

The payroll cycle includes numerous activities, from gathering payroll inputs to calculating salaries and making payouts, among others. Let’s look at the core features of a good payroll software for startups.

- Customizable salary structures

- Unlimited salary components

- Payroll inputs

- Flexible benefit plan (FBP)

- Reimbursements & expenses

- Payroll processing

- Statutory compliance

- Accounts JV

- Verification & reconciliations

- Statutory compliance

- Loans & salary advances

- Salary transfer to bank account

- Payslip generation & distribution

- Reports and statements

Zeroing in on an Advanced Payroll Software

The decision to select or upgrade a payroll software calls for the evaluation of multiple parameters. Businesses in their initial stages may not have the bandwidth to make heavy investments in technology. However, prudent use of technology can help these businesses, particularly startups, control costs and boost operational efficiency. Let’s look at a few criteria for selecting payroll software for startups.

Scalability

Startups are likely to increase their headcount faster than their larger counterparts. When this happens, they must also wield the know-how and tools to manage their payroll effectively. At this juncture of their business journey, they must deploy a payroll software that provides easy access to more helpful features. When the payroll software functions without glitches, their employees get paid accurately and on time. This results in better employee motivation and higher productivity.

Ease of operation

The deployment of a payroll software is a good milestone in the journey of a startup. But it shouldn’t end there. The HR/payroll team has to use it optimally to realize the full range of benefits. A complex solution defeats the purpose for which it has been deployed. The chosen software must be easy to learn and use. The technology provider must also provide the necessary training and documents after the payroll software is implemented.

Employee self-service portal

Only a sophisticated and financially sound startup will be able to employ a full-fledged payroll/HR team from the get-go. Hence, it makes more sense for these businesses to have a full-suite HRMS platform with a self-service portal and mobile app. Employees can use the same to mark attendance, apply for leave, download payslips, and do much more without reaching out to HR. The payroll module will automate payroll-related tasks seamlessly. This helps HR focus on more business growth-oriented tasks instead of handling repetitive employee queries related to payroll.

Integration with other systems

There are many methods and tools to process payroll. However, an advanced payroll software will have the provision for seamless integration with time, leave, and attendance management systems and accounting software. Modern payroll automation tools use AI/ML to extract information from multiple sources and process payroll quickly and accurately. Since all the activities are performed on one platform, the payroll team can experience stress-free month ends, month after month!

Security

A professional business has to collect personal information from employees for compliance purposes. Along with this, they handle other sensitive data such as bank details, Emirates ID. Therefore, the payroll software must ensure data security through data encryption, 2-factor authentication, restricted access, and password protection, among other measures.

Support

Not all startups would have the resources to handle payroll or payroll software-related complexities. Therefore, they must identify a vendor who offers timely and personalized technical support from the outset. Their plans must be flexible and affordable enough to allow this provision. The providers of advanced payroll software solutions usually offer a comprehensive suite of support resources for both employers and employees. The concerned team can access this support through multiple channels like phone, email, chat, and in person.

Summing Up

Productivity and profitability are usually the top priorities of startup companies. But they can’t afford to give the other functions a stepmotherly treatment. Payroll, for instance, is a crucial function responsible for accurate and prompt salary payouts. The payroll team must also address employee benefit-related queries thoughtfully and professionally. Not every emerging business would have comprehensive policies for everything related to HR and payroll.

An advanced payroll software can address the challenges of payroll processing. It automates many of the tasks and creates more bandwidth for payroll managers. Even the employees can perform basic payroll-related tasks on their own. This results in higher employee satisfaction. For this to happen, the business has to choose the right payroll software that is scalable and easy to operate. It must also be secure and interoperable. Most importantly, the level of support and the vendor’s credibility matter a lot. All said and done, it pays to deploy an advanced payroll software in any business, whether a startup or a large enterprise.