A lot of your organization’s time, effort and money go into ensuring that payroll is compliant through a statutory audit. From employee’s fair treatment of labor to protecting the company from unreasonable wage or benefit demands from trade unions or aggressive employees, every company faces a worrying number of potential legal issues relating to compliance. However, it may never be a company’s intent to break these laws, but without necessary protection, it may easily slip through the cracks.

So how can you be sure that you can avoid the risk of non-compliance?

To address this, let’s first understand what statutory compliance is and the various compliances required for Indian payroll.

What is Statutory Compliance?

The word statutory means "of or related to statutes"- rules and regulations. Compliance means adherence. Thus, Statutory Compliance means adhering to rules and regulations.

Statutory Compliance in HR refers to the legal framework that an organization should adhere to in dealing with its employees.

Table of Contents

- 1. Why is it important?

- 2. Need for Statutory Compliance

- 3. Is it different for organization

- 4. Advantages of Statutory Compliance

- 5. Risk of non compliance

- 6. Minimum Wages Act, 1948

- 7. The Payment of Bonus Act, 1965

- 8. Tax Deduction at Source (TDS)

- 9. Amendments to Maternity Benefit Act, 1961

- 10. Equal Remuneration Act, 1976

- 11. Shops & Establishments Act

- 12. The Employees' State Insurance Act, 1948

- 13. Employees Provident Fund (PF) and Miscellaneous Provisions Act, 1952

- 14. The Payment of Gratuity Act, 1972

- 15. Labour Welfare Fund Act, 1965

Why is it important?

Every country has its own set of state and central labor laws that companies need to comply with. Dealing with statutory compliance requires companies to be updated on all the labor regulations in their country. It is also mandatory for companies to adhere to them. Non-compliance with these regulations can cause a company a lot of legal trouble such as penalties and fines. That is why every company invests a huge amount of money, effort and time to meet compliance requirements from professional tax to minimum wages act. To help in this, the company seeks expert advice from labour law and taxation law experts.

In order to manage with demanding regulatory environment, every company should be well versed and take notice of all regulations in the labour laws. They need to formulate efficient ways to maintain compliance and minimize risks.

Need for Statutory Compliance

The complexity of doing business has increased tremendously and it has become very challenging to be in sync with the operational aspect of every business. As discussed earlier, organization seek the help of statutory compliance experts whose main focus is to be compliant with the ever-changing regulatory environment.

Also, a lot of companies also provide services on statutory compliance management and have a deeper understanding of the regulatory setting and provide specialized services to organizations. They streamline the process right from the day to day maintenance of prescribed forms and registers to the filing along with reports.

Is it different for organization

Statutory compliance for a partnership firm, private limited company, LLP, or any type of company does not change. Every organization that hires employees and pays salaries must comply with the labor laws.

Advantages of Statutory Compliance

The advantage of statutory compliance for employees

Ensures fair treatment of employees

Ensure they are paid fairly for the work they have done and their company complies with the minimum wage rate

Prevents employees from working for long hours or inhuman condition

The advantage of statutory compliance to organizations

Avoids penalty or fines because of their timely payments

Protects the organization from unreasonable wage or benefit demands from trade unions

Prevents legal troubles as the company is fully compliant

Mitigates risks and increases awareness about compliance

With compliance in place, there is a lower risk of an adverse incident

Risk of non compliance

If a company does not conform to rules and regulations it will risk:

Penal actions and financial losses to the organization

Loss of reputation and business integrity

Customer loyalty will be impacted severely

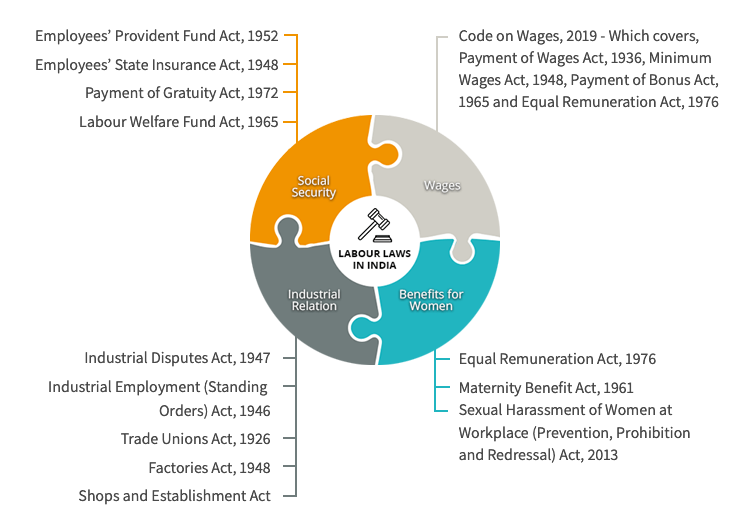

Payment of Wages Act, 1936

The Payment of Wages Act, 1936 regulates the payment of wages to direct and indirect employees. The act warrants payments of wages on time and without any deductions except those authorized under the Act. According to this act, the payment should be made before 7th of every month where the no. of workers are less than 1000 and on the 10th day if greater than 1000.

The Payment of Wages Act, 1936 regulates the payment of wages to employees (direct and indirect). The Payment of Wages Act regulates the payment of wages to certain classes of persons employed in industry, and its importance cannot be underestimated. The Act guarantees payment of wages on time and without any deductions except those authorized under the Act. The wage period shall not exceed 1 month.

The Payment of Wages Act does not apply to employees whose wage is Rs. 10000 or more per month. The Act also provides to the effect that a worker cannot contract out of any right conferred upon him under the Act.

Under the act, the payment has to be made in cash. Cheque payment or crediting wages to a bank account is allowed with the consent of employee in writing. The deduction made by the employer should be made by this act only.

Under the act, payment has to be made in currency notes or coins. Cheque payment or crediting to bank account is allowed with the consent in writing by the employee. (Section 6)

This Act includes fines for (Section 8), absence from duty (Section 9), Damages or loss (Section 10), deduction for services (amenities) given by employer (Section 11) recovery of advances and loans (Section 12, 13) and payment to cooperative society and insurance (Section 13).

Get to know the forms and compliances for Karnataka Payment of Wages Act.

Minimum Wages Act, 1948

Minimum wages rates in India are fixed under the Minimum wages Act, 1948 and is determined both by the Central Government and the Provincial governments. Minimum wages rates may be established for any region, occupation, and sector and declared at the national, state, sectoral and occupational levels. The minimum wages is determined by considering cost of living.

While fixing the minimum wages rate, it may be set for different work classes in the same scheduled employment or set for different scheduled employment. It may also be fixed by hour, day, month or any other wage period.

Under the Minimum Wages Act, both the Central and State Governments may notify the scheduled employments and fix/revise minimum wage rates for these scheduled employments.

There are two methods for fixing/revising minimum wages:

Under the committee method, the government sets up committees and subcommittees to hold inquiries and recommendations for fixing and changing minimum wages.

In the notification method, government proposals get published in the Official Gazette for persons who are likely to be affected and specifies a date (not less than two months from the time of the notification) where the proposals are taken into consideration.

The government after considering the advice of committees and all the representations received by the specified date, fixes /revises the minimum wage of the concerned scheduled employment which comes into force after three months from the date of its issue.

The Payment of Bonus Act, 1965

The Payment of Bonus Act provides an annual bonus to the employee in the certain establishment- including factories and establishments employing 20 or more persons Under the Act, The bonus is calculated by the employee’s salary and the profits of the establishment.

Employees drawing ₹21000 per month or less (basic + DA, excluding other allowances) and have completed 30 working days in that financial year are eligible for the bonus payment.

Salary or wages include only basic and DA for the bonus payment, and the rest of the allowances (e.g., HRA, overtime, etc.) are excluded. Bonus should be paid at a minimum rate of 8.33% and maximum rate of 20%. It needs to be paid within 8 months from the close of the accounting year.

Employees can be disqualified from bonus payments if they are dismissed by fraud, misconduct, or even absenteeism. The employer needs to ensure that on dismissal, the procedures of domestic inquiry, proper documentation and employee acceptance of the misconduct are all carried out as per the standing orders before disqualifying the bonus payment.

Know more on The Payment of Bonus Act.

Tax Deduction at Source (TDS)

TDS is deducted from the payments made by the individuals as per Income Tax Act. It is managed by the Central Board of Direct Taxes (CBDT), which comes under the Indian Revenue Services (IRS).

Under TDS, when an assessee gets his income, there will be a TDS deduction by the person (deductor) paying the assessee and is submitted to the income tax department.

The assessee then files the TDS return and the tax calculated from his income will be deducted and the final amount will be refunded.

TDS is exempted in the following 2 cases:

If the receiver gives a self-declaration saying that he had made the required investments in FORM 15G/15H

If there is a certificate of exemption provided by the Assessing Officer

Tax Deductions:

[Source: Tax Rates]

In this part you can gain knowledge about the normal tax rates applicable to different taxpayers. For special tax rates applicable to special incomes like long term capital gains, winnings from lottery, etc. refer “Tax Rates” under “Tax Charts & Tables”.

Old Tax Regime for Individual & HUF:

Old Tax Regime is the default tax regime for the taxpayers for the Assessment year 2023-24. However, for the Assessment Year 2024-25, the taxpayer has to exercise the option under section 115BAC(6) to avail the benefit of old tax regime.

The normal tax rates applicable to a resident individual will depend on the age of the individual. However, in case of a non-resident individual the tax rates will be same irrespective of his age. For the purpose of ascertainment of the applicable tax slab, an individual can be classified as follows:

- Resident individual below the age of 60 years.

- Resident individual of the age of 60 years or above at any time during the year but below the age of 80 years.

- Resident individual of the age of 80 years or above at any time during the year. Non-resident individual irrespective of age.

Non-Resident Individual/HUF:

New tax regime Rate for Individual, HUFs, AOP, BOI and AJP:

New tax regime (also known as alternative tax regime) is optional for the Assessment Year 2023-24. An individual or HUF has to exercise the option under section 115BAC(5) to avail its benefit.

However, for the Assessment Year 2024-25, the new tax regime is the default tax regime for the Individual or HUF. Further, the benefit of new tax regime has also extended to Association of Persons (AOP)/Body of Individuals (BOI) and Artificial Juridical Person (AJP) w.e.f. Assessment Year 2024-25. If one to opt-out from default new tax regime, he has to exercise the option under section 115BAC(6).

The tax rates under the new tax regime are as under:

(a) For Assessment Year 2023-24:

(b) For Assessment Year 2024-25:

AMT:

The assessee opting for this scheme have been kept out of the purview of Alternate Minimum Tax (AMT). Further the provision relating to the computation, carry forward and set off of AMT credit shall not apply to these assessees.

Note:

(a) For Assessment Year 2023-24, a resident individual (whose net income does not exceed Rs. 5,00,000) can avail rebate under section 87A. It is deductible from income-tax before calculating education cess. The amount of rebate is 100 per cent of income-tax or Rs. 12,500, whichever is less.

(b) From Assessment Year 2024-25, a maximum rebate of Rs. 25,000 is allowed under section 87A, If the total income of an individual, who is opting for the new tax scheme under Section 115BAC(1A), is up to Rs. 7,00,000. Further, if the total income of the resident individual (opting section 115BAC(1A) exceeds Rs. 7,00,000 and the tax payable on such income exceeds the difference between the total income and Rs. 7,00,000, he can claim a rebate with marginal relief to the extent of the difference between the tax payable on such total income and the amount by which it exceeds Rs. 7,00,000

(c) If an assessee has opted for new tax regime, the provisions of AMT shall not be applicable.

Conditions to be satisfied:

The option to pay tax at lower rates shall be available only if the total income of assessee is computed without claiming following exemptions or deductions:

a) Leave Travel concession [Section 10(5)]

b) House Rent Allowance [Section 10(13A)]

c) Official and personal allowances (other than those as may be prescribed) [Section10(14)]

d) Allowances to MPs/MLAs [Section 10(17)]

e) Allowances for income of minor [Section 10(32)]

f) Deduction for units established in Special Economic Zones (SEZ) [Section 10AA];

g) Standard Deduction [Section 16(ia)] (Allowable for Assessment Year 2024-25)

h) Entertainment Allowance [Section 16((ii)]

i) Professional Tax [Section 16(iii)]

j) Interest on housing loan [Section 24(b)]

k) Additional depreciation in respect of new plant and machinery [Section 32(1)(iia)];

l) Deduction for investment in new plant and machinery in notified backward areas [Section 32AD];

m) Deduction in respect of tea, coffee or rubber business [Section 33AB];

n) Deduction in respect of business consisting of prospecting or extraction or production of petroleum or natural gas in India [Section 33ABA];

o) Deduction for donation made to approved scientific research association, university college or other institutes for doing scientific research which may or may not be related to business [Section 35(1)(ii)];

p) Deduction for payment made to an Indian company for doing scientific research which may or may not be related to business [Section 35(1)(iia)];

q) Deduction for donation made to university, college, or other institution for doing research in social science or statistical research [Section 35(1)(iii)];

r) Deduction for donation made for or expenditure on scientific research [Section35(2AA)];

s) Deduction in respect of capital expenditure incurred in respect of certain specified businesses, i.e., cold chain facility, warehousing facility, etc. [Section 35AD];

t) Deduction for expenditure on agriculture extension project [Section 35CCC];

u) Deduction for family Pension [Section 57(iia)] (Allowable for Assessment Year 2024-25)

v) Deduction in respect of certain incomes other than specified under Section 80JJAA, 80CCD(2),80CCH(2) for the contribution made by the central government to the Agniveer Corpus Fund (Allowable for Assessment Year 2024-25) and deduction under section 80LA for Unit located in IFSC [Part C of Chapter VI-A].

Normal tax rates applicable to a firm:

A firm is taxed at a flat rate of 30%. Apart from tax @ 30%, Health and Education Cess is levied @ 4% of income-tax.

Surcharge : Surcharge is levied @ 12% on the amount of income-tax where net income exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be levied on the amount of income-tax plus surcharge.

The Health and Education Cess is nil if the total income of a ‘specified fund’ as referred to section 10(4D) includes any income in respect of securities as given under section 115AD(1)(a). [For assessment year 2024-25]

However, marginal relief is available from surcharge in such a manner that in the case of a person having a net income of exceeding Rs. 1 crore, the amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayers to whom the provisions of Alternate Minimum Tax (AMT) applies, tax payable cannot be less than 18.5% (+SC+HEC) of "adjusted total income" computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in tutorial section.

Normal Tax Rates applicable to a Domestic Company:

Income-tax rates applicable in case of domestic companies for assessment year 2023-24 and 2024-25 are as follows:

Special Tax rates applicable to a domestic company:

The special Income-tax rates applicable in case of domestic companies for assessment year 2023- 24 and 2024-25 are as follows:

Normal tax rates applicable to a Co-operative societies:

Apart from tax at above rate, Health and Education Cess is levied @ 4% of income-tax.

Note: The Health and Education Cess is nil if the total income of a ‘specified fund’ as referred to section 10(4D) includes any income in respect of securities as given under section 115AD(1)(a). [For assessment year 2024-25]

Surcharge: Surcharge is levied @ 12% on the amount of income-tax where net income exceeds Rs. 1 crore . In a case where surcharge is levied, HEC of 4% will be levied on the amount of income-tax plus surcharge.

Note: From Assessment Year 2023-24 onwards, the rate of surcharge in the case of co-operative societies having income between 1 crore to 10 crores is reduced from 12% to 7%.

However, marginal relief is available from surcharge in such a manner that in the case of a person having a net income exceeding Rs. 1 crore, the amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

Similarly, if the net income exceeds Rs. 10 crore, the amount payable as income-tax and surcharge shall not exceed the total income payable as income-tax and surcharge on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore.

AMT: In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum Tax (AMT) applies, tax payable cannot be less than 15% (+SC+HEC) of "adjusted total income" computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in tutorial section.

In case of a unit located in an IFSC which derives its income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at the rate of 9% instead of existing rate of 15%.

Special tax rates applicable to a Co-operative societies For Resident co-operative societies:

The Finance Act, 2020 has inserted a new section 115BAD in Income-tax Act to provide an option to the co-operative societies to get taxed at the rate of 22% plus 10% surcharge and 4% cess. The resident co-operative societies have an option to opt for taxation under newly section 115BAD of the Act w.e.f. Assessment Year 2022-23. The option once exercised under this section cannot be subsequently withdrawn for the same or any other previous year.

If the new regime of Section 115BAD is opted by a resident co-operative society, its income shall be computed without providing for specified exemption, deduction or incentive available under the Act. The societies opting for this section have been kept out of the purview of Alternate Minimum Tax (AMT). Further, the provision relating to computation, carry forward and set- off of AMT credit shall not apply to these assessees.

The option to pay tax at lower rates shall be available only if the total income of co- operative society is computed without claiming following exemptions or deductions:

a) Deduction for units established in Special Economic Zones (SEZ) [Section 10AA];

b) Additional depreciation in respect of new plant and machinery [Section 32(1)(iia)];

c) Deduction for investment in new plant and machinery in notified backward areas [Section 32AD];

d) Deduction in respect of tea, coffee or rubber business [Section 33AB];

e) Deduction in respect of business consisting of prospecting or extraction or production of petroleum or natural gas in India [Section 33ABA];

f) Deduction for donation made to approved scientific research association, university college or other institutes for doing scientific research which may or may not be related to business [Section 35(1)(ii)];

g) Deduction for payment made to an Indian company for doing scientific research which may or may not be related to business [Section 35(1)(iia)];

h) Deduction for donation made to university, college, or other institution for doing research in social science or statistical research [Section 35(1)(iii)];

i) Deduction for donation made to National Laboratory or IITs, etc. for doing scientific research which may or may not be related to business [Section 35(2AA)];

j) Deduction in respect of capital expenditure incurred in respect of certain specified businesses, i.e., cold chain facility, warehousing facility, etc. [Section 35AD];

k) Deduction for expenditure on agriculture extension project [Section 35CCC];

l) Deduction in respect of certain incomes other than specified under Section 80JJAA [Part C of Chapter VI-A].

Where a co-operative society exercises option for availing benefit of lower tax rate under section 115BAD, it shall not be allowed to claim set-off of any brought forward losses or depreciation attributable to any restricted exemption or deduction in the Assessment Year for which the option has been exercised and for any subsequent Assessment Year.

For new manufacturing resident co-operative Societies:

The Finance Act, 2023 introduced a new tax scheme under section 115BAE for the resident co-operative societies engaged in the manufacturing or production of an article or thing. This new scheme will be applicable from the assessment year 2024-25. If a co-operative society opts for this scheme, then income will be taxable at a concessional rate of 15%.

However, any income derived from non-manufacturing or production activities will be taxed at the rate of 22%.The option to pay tax at lower rates shall be available only if the total income of co- operative society is computed without claiming following exemptions or deductions:

(a) Deduction for units established in Special Economic Zones (SEZ) [Section 10AA];

(b) Additional depreciation in respect of new plant and machinery [Section 32(1)(iia)];

(c) Deduction in respect of tea, coffee, or rubber business [Section 33AB];

(d) Deduction in respect of business consisting of prospecting or extraction or production of petroleum or natural gas in India [Section 33ABA];

(e) Deduction for the donation made to an approved scientific research association, university, college, or other institute for doing scientific research which may or may not be related to business [Section 35(1)(ii)];

(f) Deduction for payment made to an Indian company for doing scientific research which may or may not be related to business [Section 35(1)(iia)];

(g) Deduction for donation made to a university, college, or other institution for doing research in social science or statistical research [Section 35(1)(iii)];

(h) Deduction for donations made to National Laboratory or IITs, etc., for doing scientific research which may or may not be related to business [Section 35(2AA)];

(i) Deduction in respect of capital expenditure incurred in respect of certain specified businesses, i.e., cold chain facility, warehousing facility, etc. [Section 35AD];

(j) Deduction for expenditure on agriculture extension project [Section 35CCC];

(k) Deduction under Chapter VI-A other than specified under Section 80JJAA.

Where a co-operative society exercises option for availing benefit of lower tax rate under section 115BAE, it shall not be allowed to claim set-off of any brought forward losses or depreciation attributable to any restricted exemption or deduction in the Assessment Year for which the option has been exercised and for any subsequent Assessment Year.

The tax calculated on the total income shall be further increased by the surcharge. The surcharge shall be levied at the rate of 10% of tax on total income. Further, the amount of income tax and the surcharge shall be increased by health and education cess calculated at the rate of 4% of such income tax and surcharge.

From the assessment year 2024-25, the co-operative societies opting for the new tax scheme under Section 115BAE have also been given an exemption from the payment of AMT.

The eligible co-operative society has to exercise the option in the prescribed manner on or before the due date for furnishing the first return of income under Section 139(1) for any previous year relevant to the assessment year commencing on or after 01-04-2024. Once such an option is exercised, it shall apply to subsequent assessment years. The manner of exercising the option shall be prescribed by the CBDT.

Further, Where it appears to the Assessing Officer that, owing to the close connection between the co-operative society and any other person, or for any other reason, the course of business between them is so arranged that the business transacted between them produces to the society more than the ordinary profits, the Assessing Officer shall, in computing the profits and gains of such society for the purposes of this section, take the amount of profits as may be reasonably deemed to have been derived there from.

In case the aforesaid arrangement involves a specified domestic transaction, the amount of profits from such transaction shall be determined having regard to arm’s length price as defined in Section 92F.

The profits in excess of the amount of the profits determined by the Assessing Officer shall be deemed to be the income of the co-operative society and charged to tax at the rate of 30%.

Amendments to Maternity Benefit Act, 1961

The maternity benefits to the employed pregnant woman (“Claimant”) are governed under Maternity Benefit Act, 1961 (“MBA”) and Employees’ State Insurance Corporation Act, 1948 (“ESIC”).

MBA is enacted –

- to regulate the employment of women in certain establishments for certain periods before and after childbirth and

- to provide for maternity benefit and certain other benefits.

To whom does MBA apply

- MBA is applicable to all establishments which include factories, plantations, mines belonging to Government. -To every establishment wherein persons are employed for the exhibition of equestrian, acrobatic and other performances.

- Any shop or establishment that falls within the purview of laws for shops and establishments in any State wherein ten or more persons are employed or were employed within the preceding twelve months.

- To women who cannot claim under ESIC for the reason of her income being above INR 3000/- per month.

To whom MBA does not apply

This law is not applicable to those women to which the ESIC is applicable.

What are the Maternity Benefits

- It is the benefit of payment that a woman during her pregnancy can claim for her pre-natal and post-natal absence from work which will be considered as paid maternity leave.

- The payment is calculated at an average daily wage which is equivalent to the period of three calendar months during her absence i.e. maternity leave which includes her pre-natal period that immediately precedes her day of delivery, the day of delivery and the post-natal period permissible under MBA.

- This benefit can be claimed by the woman who should have worked not less than 80 days in the preceding twelve months from her expected date of delivery which also includes women employed in casual or muster roll basis on daily wages. This benefit is not applicable to a woman who has immigrated to Assam or was pregnant during such immigration.

- In the event of woman’s death during the delivery or during the period immediately following the delivery wherein the child survives, the deceased woman is entitled to full maternity benefit for such period to the surviving child. Hence the employer is liable to pay the full maternity benefit.

- In the event of a child’s death at the time of delivery or any day after the delivery, the benefit has to be calculated till such period including the date of death of the child.

- If the employer is not providing free medical care then the employer has to pay a sum of INR 3,500/- to the claimant. This is w.e.f. 19.12.2011.

Procedure to be adopted by the claimant

- Inform her employer in writing the period of leave and benefits to be availed as prescribed by the establishment; (if the notice cannot be given before delivery, the claimant can notify the employer at the earliest possible after delivery; failure to notify employer does not disentitle the claimant from the benefits),

- Declare that she will not undertake any other employment during such period,

- Provide medical records as proof that claimant has delivered the child.

Do’s & Don’ts to employer

The employer shall not engage the claimant in any heavy strenuous work and shall engage the claimant only in light work for ten weeks before the date of expected delivery. The employer shall NOT, during such period of leave/absence of the claimant,

- Reduce the daily wages of the claimant for the reasons for her absence or allocation of less stressful work,

- Discharge or dismiss the claimant for the reason of her absence, or

- Serve any notice of dismissal which will expire during her period of absence

- However, the employer can do the above and can also deprive the maternity benefits in the event of gross misconduct committed by the claimant and such discharge/dismissal notice shall be duly served to the claimant stating reasons; the claimant is entitled to appeal to the appropriate authorities within sixty days from the date of receipt of such notice for relief.

The unlawful discharge, dismissal of claimant and non-payment of benefits by the employer attract imprisonment not less than three months up to one year or fine not less than INR 2000/- up to INR 5000/- or both.

2017 Amendment in MBA with enhanced benefits – an aerial view

Know more on the compliance and rules in The Maternity Benefit Act, 1961 and 2017 Amendment in MBA with enhanced benefits.

Equal Remuneration Act, 1976

The Equal Remuneration Act, 1976 provides for the payment of equal remuneration to men and women workers for the same work and prevents discrimination, on the ground of sex, against women in the matter of employment, recruitment and for matters connected in addition to the that or incidental to it. This Act applies to virtually every kind of establishment.

Refer here to know more about the compliance in this act.

Shops & Establishments Act

The Shop and Establishment Act is to regulate the employment condition of workers in shops and establishments. This includes work hours, rest intervals, overtime, holidays, termination of service, etc.

Registration needs to be done within 30 days from the date of commencement of business. Even if there is no employee, the entity has to get registered under this act.

An application has to be submitted along with the fee and the scanned documents online. Within 15 days of successful document submission, the department approves the registration. The registration certificate can be downloaded from the portal.

A registration certificate is valid for 5 years and should be renewed after that.

In case of a change in address, status, partners intimation has to be given to the department within 30 days of change through an online application. The registration fee depends on the number of employees hired by the entity. Additional fee has to be paid through filing an online application when there is an increase in headcount, pay, etc.

The annual return should be filed online in Form U on or before 31st January of the subsequent year.

The Employees' State Insurance Act, 1948

The ESI Act provides certain benefits to employees in case of sickness, maternity and employment injury. The act applies to non-seasonal factories using power and employing more than 10 employees, and non-power using factories and certain other establishments employing 20 or more employees.

All benefits are provided in ESIC hospitals, clinics and approved independent medical practitioners. The wage ceiling under this act has been enhanced from Rs. 7500 to Rs. 10000 per month.

The act provides period payments to women in case of confinement, miscarriage or related sickness. This is applicable only to the insured women. They can also claim maternity benefits of about 70% of their salary.

Know more about the ESI Act and its compliances..

Employees Provident Fund (PF) and Miscellaneous Provisions Act, 1952

The Employee Provident Fund (PF) and Miscellaneous Provisions Act, 1952 is created for the social welfare of an employee. When one begins the employment, they are expected to contribute monthly to their PF funds. The employer is also expected to contribute to its employee retirement fund.

Any factory or establishment having 20 or more employees directly or through contract is liable to be covered under this act.

The PF contribution is calculated on the basic wages and the dearness allowance. It doesn't include food allowance, House Rent allowance, overtime allowance, bonus, commission, etc.

The wage limit to be covered under this Act is Rs.15,000/- per month.

The employer contribution is calculated at 3.67% of wage in general prescribed by the Central government. Just like the employer, the employee should also pay an equal contribution.

-Eligible for deduction under 80C

The employer is liable to fines for being a defaulter. However, this can extend up to imprisonment of 3 years and a fine of Rs.10,000/-

The voluntary contribution is also covered under the Employee Provident Fund and Miscellaneous Provision Act, 1952 for an establishment having less than 20 employees.

The admin charges are highlighted below:

The Payment of Gratuity Act, 1972

The Payment of Gratuity Act applies to every shop or establishment in which 10 or more persons are employed or were employed on any day of the preceding 12 months.

There is no percentage set by the act for the gratuity amount an employee is entitled. An employer can use the formula-based approach or even pay higher than that.

Gratuity depends on 2 factors:

- Last drawn salary

- Years of service

To calculate how much gratuity is payable, the Payment of Gratuity Act, 1972 has divided non-government employees into two categories:

- Employees covered under the Act

- Employees not covered under the Act

Calculation of gratuity

- For employees covered under the Act

The amount of gratuity payable is calculated using the below formula. The formula is based on the 15 days of last drawn salary for each completed year of service or part of thereof more than six months.

The Formula: (15 X Last Drawn Salary X Tenure of Working) divided by 26

Last Drawn Salary= Basic Salary, Dearness Allowance, and Commissions Received on Sales

- For employees not covered under the Act

There is no law restricting an employer from paying gratuity to his employees even if the organization is not covered under the Act. The amount of gratuity payable to the employee can be calculated based on half month's salary for each completed year.

The Formula:

(15 X Last Drawn Salary X Tenure of Working) divided by 30

Last Drawn Salary= Basic Salary, Dearness Allowance, and Commissions Received on Sales

As per the government pensioners' portal, retirement gratuity is calculated like this: one-fourth of a month's basic pay plus dearness allowance is drawn before retirement for each completed six monthly periods of qualifying service.

In case of death of an employee, the gratuity is paid based on the length of service, where the maximum benefit is restricted to Rs 20 lakh.

Labour Welfare Fund Act, 1965

Labour welfare refers to all the facilities for labourers to improve their working conditions, provide social security, and raise their standard of living. Several state legislatures have enacted an Act exclusively focusing on the welfare of the workers, known as the Labour Welfare Fund Act. We tell you all about it here!

Labour Welfare Fund is a fund contributed by Employer, Employee and in some states by the Government as well. Separate (State) Labour Welfare Fund Act and (State) Labour Welfare Fund Rule are framed for different states & Union Territories.

How Does Labour Welfare Fund Help Labourers?

Labour Welfare Fund (LWF) help labourers in many different ways.

Improving Standard of Living

Providing nutritious food and educational facilities to the children of employees, medical facilities to the private and public sector workers and their families, housing facilities at concessional schemes and rates, etc.

Offering Better Work Conditions

Furnishing facilities for workers and employees such as commuting to work (transport), reading rooms, libraries, vocational training programs, excursions and tours, recreational facilities at the workplace, etc.

Providing Social Security

Arranging medical treatments, schemes for certain industries and subsidiary occupations for women, unemployed persons, etc.

The amount of fund, rate, and periodicity of contribution is decided by the respective State Labour Welfare Board. The contribution may be made every month or once in six months (half-yearly) or once in a year (annually) as per the prescribed quantum and remitted to appropriate Labour Welfare Fund Board in prescribed Form before the due date specified under the Act.

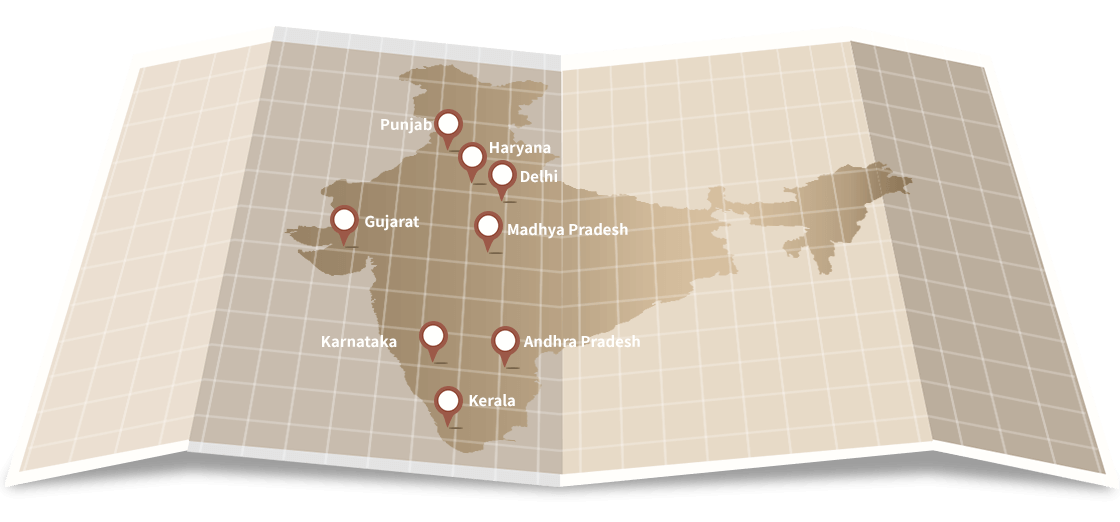

Currently, this Act is enacted and applicable in the States of Andhra Pradesh, Chandigarh, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Tamil Nadu, Telangana & West Bengal.

Labour Welfare Fund Applicability

This fund is applicable to certain establishments based on the total number of employees, the wages earned and the designation of the employee. All the parameters are prescribed under corresponding State Legislation. Click here for an overview of the Fund contributions prescribed across the States. RTI release by the government of India for Labour Welfare: Here