The Indian Budget 2024, unveiled by Finance Minister Nirmala Sitharaman, has introduced substantial changes aimed at easing the tax burden on salaried employees.

At greytHR, we are committed to helping organizations stay abreast of the latest developments in HR, payroll, and compliance. Therefore, we have compiled a quick summary of the relevant revisions for the benefit of HR teams and employees.

Take a look at the significant updates in this budget:

New Tax Regime Updates

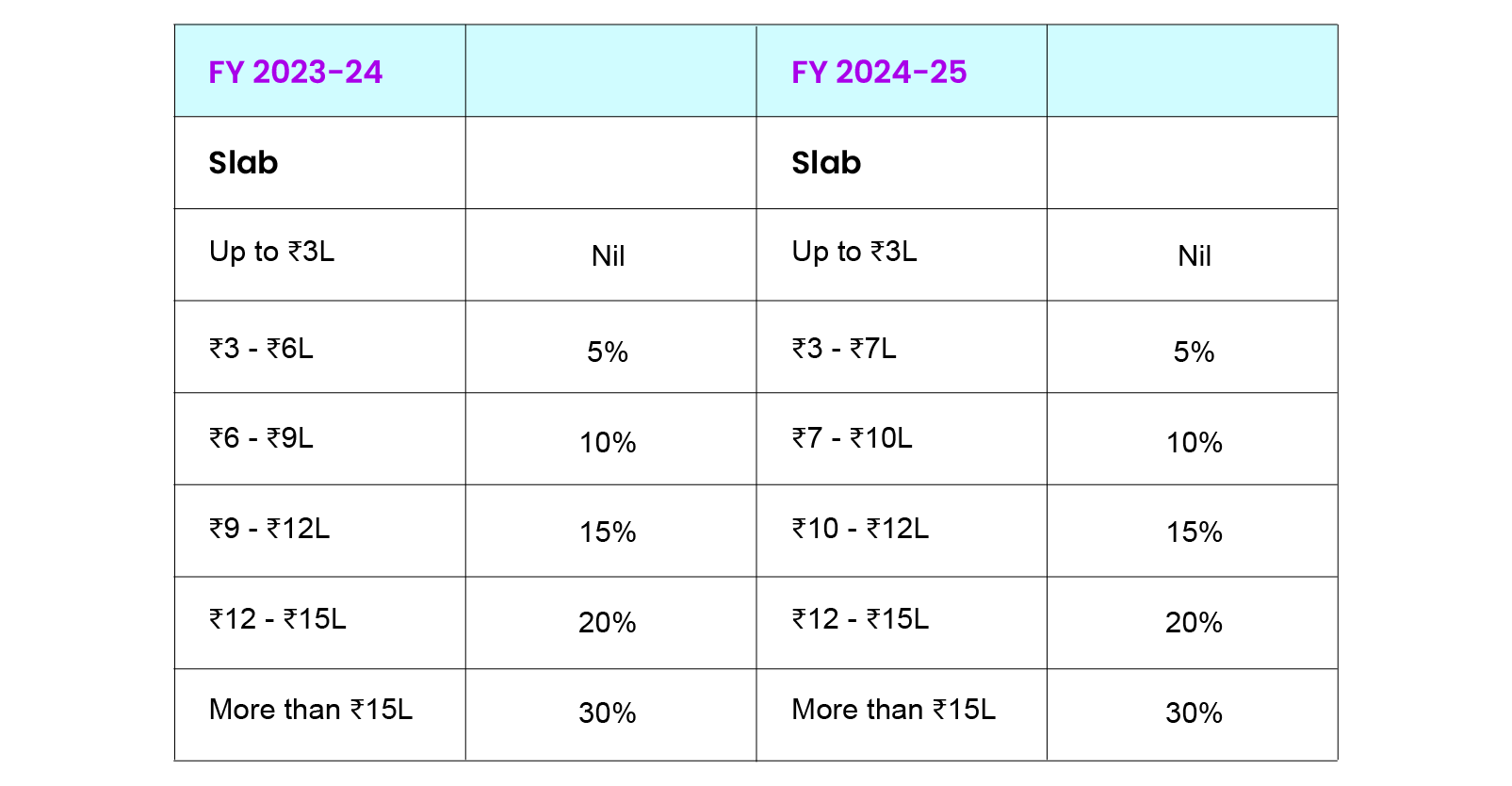

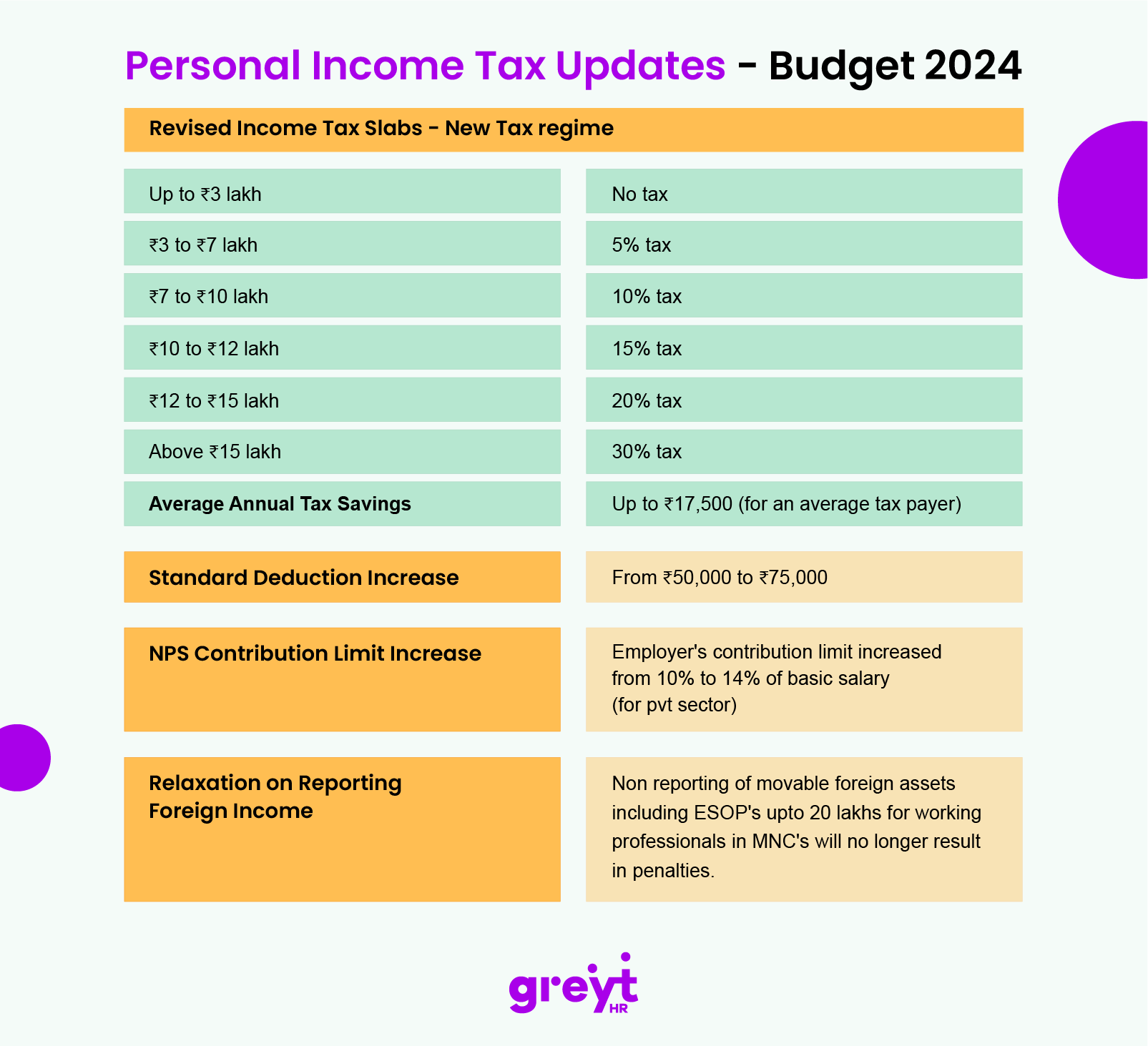

The revised income tax slabs under the new regime are designed to provide greater relief to middle-income earners:

These changes are expected to save an average taxpayer up to ₹17,500 annually, enhancing disposable incomes.

Additionally, salaried taxpayers get a standard deduction increase, from ₹50,000 to ₹75,000, in the new tax regime. There is no change on the old regime tax rates.

Increase in NPS Contribution Limits

The budget has also increased the employer's contribution limit to the National Pension System (NPS) from 10% to 14% of the employee’s basic salary for the private sector. This move aims to bolster retirement savings and align the private sector benefits with those available to central government employees.

Relaxation on Reporting Foreign Income

The budget has introduced a proposal to de-penalize the non-reporting of foreign movable assets, including income from Employee Stock Option Plans (ESOPs), for employees working in multinational companies, if the total value is up to ₹ 20 lakh. This change aims to simplify compliance for individuals with modest foreign incomes and reduce the administrative burden associated with reporting these earnings, mitigating the penal consequences under the Black Money Act.

Conclusion

The Indian Budget 2024 has introduced significant reforms to simplify tax compliance and provide financial relief to salaried employees. The new tax regime offers a more straightforward structure with higher standard deductions, while the increased NPS contribution limits aim to enhance social security and retirement savings. Additionally, the relaxation on reporting foreign income reduces compliance burdens for those earning moderate amounts from foreign sources. These measures collectively promote a more robust and equitable economic environment, encouraging savings, investments, and compliance among taxpayers.

These updates underscore the government's commitment to making the tax system more taxpayer-friendly and aligned with the current economic landscape, fostering financial stability and growth.

About The Author

Surya is an expert in HR technology and serves as a VP of Engineering, with 16+ years of experience ensuring the successful delivery of high-quality software solutions. As a senior leader at Greytip Software, Surya focuses on leveraging technology to solve complex HR challenges and enhance people's experience.

About greytHR

greytHR is a full-suite HRMS platform that simplifies, expedites, and even automates complex, recurring, and yet critical functions of HR and Payroll, in a compliant and secure way. greytHR offers productivity tools for better people management, simpler HR processes, and professional delivery of HR and Payroll services.

While it has a vast portfolio of HR and Payroll products, greytHR’s deep product expertise is in Administrative HR, Payroll, Workforce Management, and Employee Engagement. The platform also offers an app marketplace, mobile-first ESS, and experts-led implementation.

greytHR software is currently used by 23,000+ organizations and 2.3 million users in India, and 30+ countries.