If you are trying to generate Form 16 for your employees, here is a step-by-step guide that will answer most of your questions and help your employees file their taxes in no time.

New! According to a recent Central Board of Direct Taxes (CBDT) ruling, both -Form 16 Part A and Form 16 Part B will now be available on TRACES.

The deadline for filing taxes is approaching, and most employees are still running after their HRs asking that one crucial question - Where is my Form 16?

Form 16 is an important tax document for an employer mainly because of two reasons:

- it ensures compliance.

- it helps the employees file returns without any hassle.

The tax-filing process is complex and can get even the most seasoned experts looking for answers. As an employer, if you have deducted TDS for your employees, it is your legal duty to procure and publish Form 16. Your employees need this document because this is where they get the information required for filling their income tax returns (ITR). It also serves as a valid proof of TDS.

Did you know? According to section 272A(2)(g) of the I-T Act, you may even be penalized if you fail to comply with the norms.

If you are on your way towards generating Form 16 for your employees, here's everything you will need to tackle this problem head-on.

Table of Content:

- Form 16: Concept and Component

- The recent amendment

- Primary Checklist

- How to get it done with TRACES

- FAQs

1. Form 16: Concept and Components

Form 16 is a certificate that reflects the total salary paid and the amount of tax deducted (TDS) during the year. It also contains the details of salary and tax benefits availed by your employees in the last financial year.

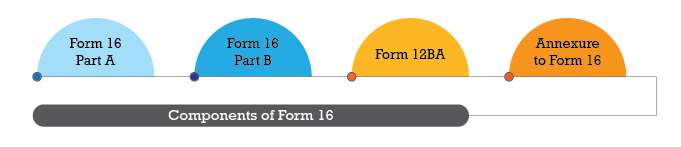

There are several layers to Form 16 - each unique and at the same time, vital to the tax filing journey. It mainly consists of four parts:

- Form 16 Part A - Contains the summary of income paid, taxes deducted and remitted.

- Form 16 Part B - Contains details of the total salary paid.

- Form 12BA - Shows the value of perquisites.

- Annexure to Form 16 - Provides a break up of Sec 2(f) and 10(k)

2. The Recent Amendment

Until recently, ‘Part A’ was being generated through TRACES, and it was up to the employers to create ‘Part B’ along with the other three annexures (Part-B, Form-12BA, and Annexure) from their payroll system.

According to the new Central Board of Direct Taxes (CBDT) ruling, both - Form 16 Part A and Form 16 Part B will now be available through a government portal called TRACES (Tax deducted at source (TDS) Reconciliation Analysis and Correction Enabling System).

What changes for you?

The fundamentals remain the same. However, unlike before, you can now download both Part A and Part B from TRACES.

Also Read: How prepared are you for the new financial year? 7 steps to your payroll summary

3. Primary Checklist

The Form 16 universe is vast - and without the right instruments, you may end up in a blind spot. Before you begin, there are a couple of things that you will need to keep in mind.

- Ensure the salary details and income tax details are updated correctly.

- Keep the PAN numbers handy and ensure there is no mismatch in data.

- Map the prerequisite components to Form 12 BA.

Create a list of items you would need to generate and distribute Form 16

4. How To Get It Done With TRACES

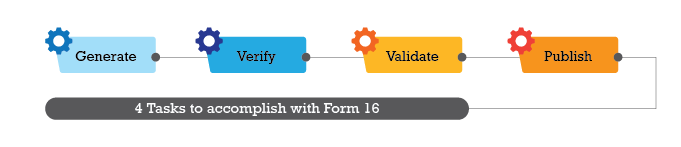

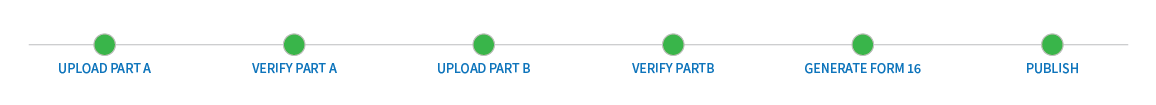

All set? You are almost there. In the following steps, we will explore the four big tasks that can be accomplished with Form 16.

- Generate Form 16

- Verify the documents

- Validate them

- Distribute them to your employees

Step By Step Guide To Generating And Distributing Form 16

Step By Step Guide To Generating And Distributing Form 16

Step 1

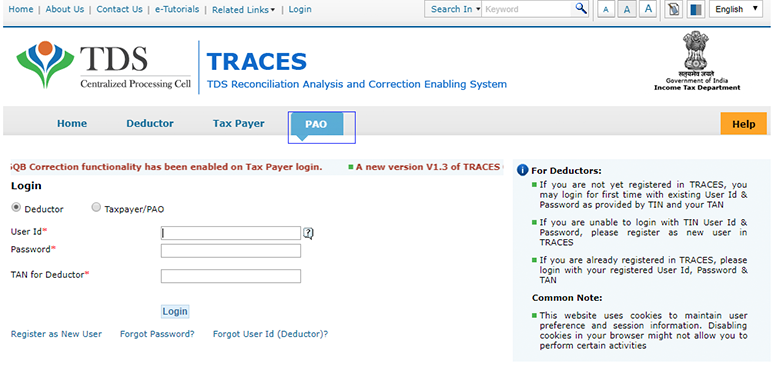

Log in to the TRACES website using your user ID, password, and TAN number.

Step 2

Step 2

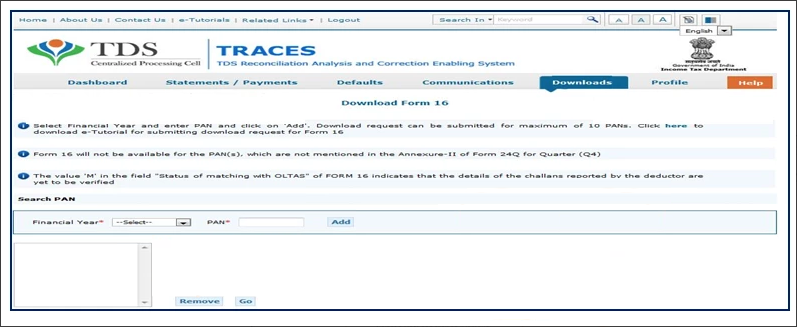

Enter the PAN numbers for which Form 16 will be generated.

Step 3

Verify Form 16 - The next important step is to verify the documents. The verification process can turn out to be a long and tedious one because there are multiple components within Form 16 that you need to look out for.

💡 Tip: Make sure all the employee data are as per the IT deduction statements

Once you have verified the documents, you will need to sign them. You can either opt for a digital signature or choose to do it manually. If you are doing it digitally, use a digital signer to speed up the process.

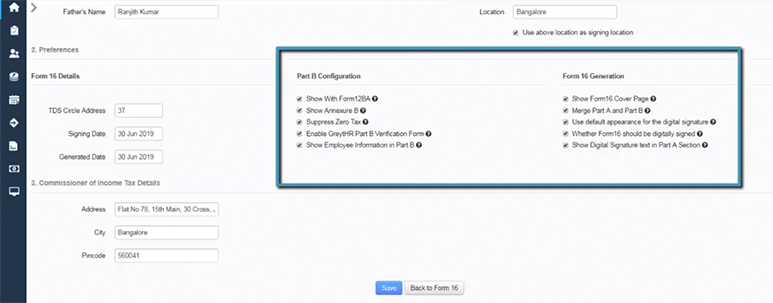

The Form 16 generation process on greytHR . Try greytHR for free.

Step 4

In the next step, validate the signature. Without validation, you would see the following image on your Form 16.

Press the right-click button while you are hovering over the image and select the ‘Validate signature’ option. Once it is done, you will see a green tick beside your digital signature.

Step 5

Finally, it is time to distribute the respective Form 16 to their correct recipients. Remember to check whether you are sending them to the right email-ids because these are crucial legal documents that contain detailed tax information of individuals. If you make an error here, you may inadvertently put someone’s data at risk.

Most of Form 16’s complexity is easily solved with a clear roadmap

FAQs

What happens to those who have generated Form 16 before May 12, 2019?

If you have issued Form 16 before May 12, 2019, you need not worry about the recent amendments. But, those releasing Form 16 after the effective date will have to adhere to the new format.

Can you download Form 16 without being registered on TRACES?

No, you cannot. You will have to be registered as a ‘deductor’ to be able to download Form 16.

Do you need Form 16 for employees with zero tax?

If no tax is deducted for an employee, Form 16 will not be applicable for him/her.

About greytHR

greytHR is the preferred HR & payroll software for Indian businesses. It vastly reduces and simplifies work while delivering accurate and super-fast results. greytHR automates key areas of HR, payroll management, leave and attendance tracking.