India’s “Naya” (new) Budget 2025 is the talk of the town!

To break it all down, greytHR’s Parichay webinar series hosted an insightful discussion featuring expert analysis from CA Ruchika Bhagat, a seasoned Chartered Accountant and business advisor with 28 years of experience.

With significant changes to the income tax landscape, this session was a must-watch for HR professionals, business owners, and gig workers.

Missed it? No worries! We have good news for you! 😀

We have delved into this informative session and presented the highlights.

Ready to navigate the changes and stay compliant with the ever-evolving law?

Dive in! 👇

Impact on Employees

Budget 2025 aims to reduce the tax burden and increase disposable income for employees, especially those in the middle-class category.

Key Changes:

- No tax on normal income up to ₹12 lakh under the new tax regime.

- Standard deduction of ₹75,000 applies to employees.

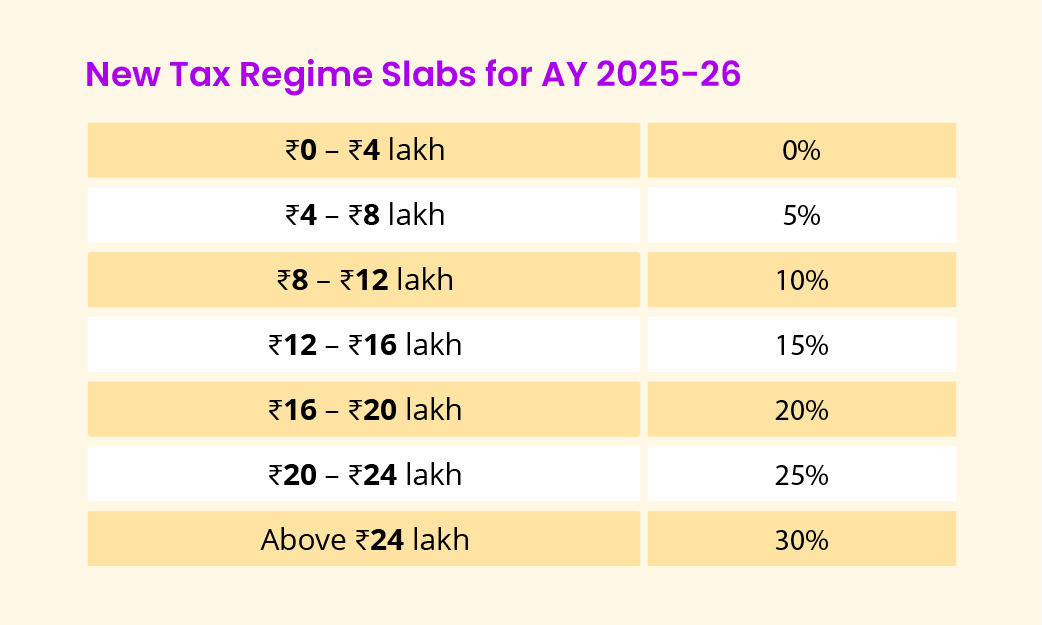

(No tax for up to ₹12.75 lakh salary income). - Revised tax slabs under the new tax regime.

New Tax Regime Slabs for AY 2025-26

- Increased TDS threshold (₹10,000) for interest/dividend on securities, dividends, etc.

HR Action Points:

- Help employees determine the most beneficial tax regime.

- Collect investment proofs for those opting for the old regime.

- Adjust TDS deductions based on the new tax slabs.

Employer Contributions & Gig Workers

- The reforms may incentivize employees to opt for a higher basic salary, increasing employer contributions to EPF and gratuity. HR should be ready for this change.

- Like regular employees, gig workers will also become eligible for social security benefits. The government is providing a registration card to help them register easily on the e-Shram portal and avail of social security benefits.

Direct Tax Code & Implications for Businesses

- The Direct Tax Code aims to simplify the taxation process for individuals. It

will replace the "previous year" and "assessment year" with a simple “tax year”, reduce the tax slabs, and provide benefits to those who house properties (no tax for two self-occupied properties).Benefits for businesses:

- Higher presumptive income thresholds for business.

- Increased TDS thresholds for different income types.

- Simplified litigation processes.

Virtual Digital Assets & Section 87A Relief

Budget 2025 clarifies the taxation of VDAs (virtual digital assets), including cryptocurrencies.

Key points:

- 30% tax on VDAs without any expense deductions.

- 1% TDS on VDA sales.

- Mandatory disclosure of VDAs during IT return filing.

- Section 87A provides a special benefit by exempting income up to ₹12 lakh, even though the tax slabs start at ₹4 lakh. It also offers a marginal relief for incomes slightly above ₹12 lakh, so the tax paid (due to slab change) is not higher than minor incremental amount received. This benefit is applicable only up ₹12.75 lakh.

In Conclusion

We released the highlights of Budget 2025 on the same day. This post, based on our Parichay webinar, highlights the key areas HR and payroll professionals should focus on. Besides the impact on employees, employers, and gig workers, it also covers aspects like direct tax code and its implications for businesses and virtual digital asset taxation. Last but not least, it touches upon a complex part where many people still want clarity: Relief under Section 87A.

The full recording of this Parichay session provides more detailed explanations and examples.

Great news! greytHR is updated with all the changes proposed in the Budget. The new slabs are automatically applied across Payroll Processing, IT Declarations, Proof of Investments (POI), and Reports.