What is the Concessional Tax Regime?

Implemented in the Finance Act, 2020, the concessional tax regime is a simplified tax regime for an employee/HUF to avail of tax benefits. An employee of an organisation currently has two options: Switch to the new regime or stick to the old one.

Anurag Jain, Co-founder, ByTheBook, joined us at our Parichay‒Ask the Expert webinar and pointed out the different changes and compared the tax rates of the two regimes in detail. He also presented the advantages and disadvantages of opting for the concessional tax regime.

Here are the key takeaways from this presentation, followed by a Q&A session.

Concessional Tax Regime vs Existing Tax Regime

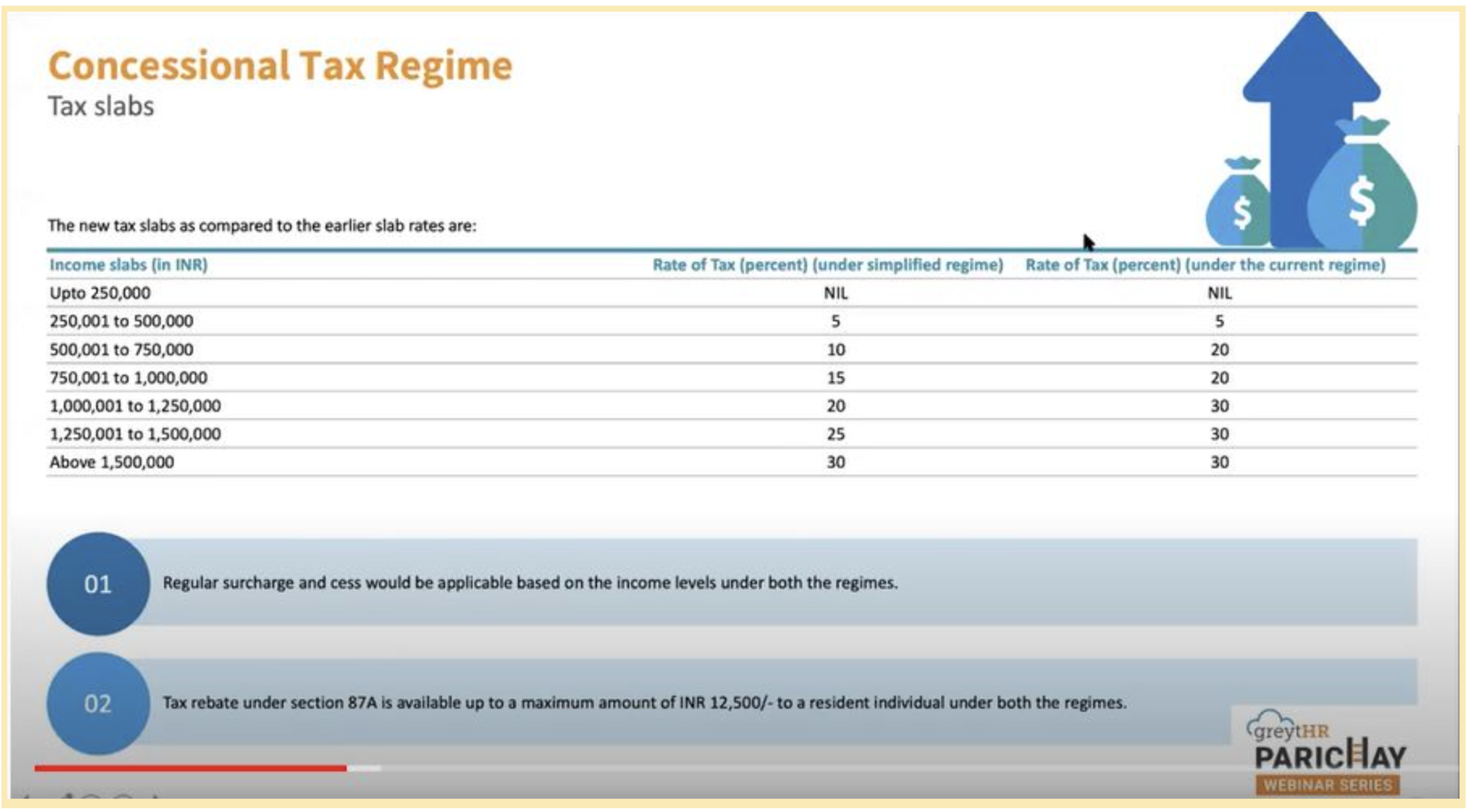

If we look at an income of INR 2.5 LPA, the tax is nil under both regimes. As we progress to higher income brackets, the rates vary. In the case of a person with a 5L income, the tax is 10% under the new regime. But it goes up to 20% under the old one. If the income is above 10L, the new regime tax is 20% (30% in the old one).

What about a salary of above 15L+? A 30% flat rate applies to both new and old tax regimes. The regular surcharge and cess will also be applicable for both. The below table should give you a clear picture of the applicable tax slabs.

Disallowed Deductions in the New Regime

- Employee's contribution to NPS

- Standard deduction

- Professional tax

- Family pension

Disallowed Exemptions in the New Regime

- Food & beverage vouchers like Sodexo

- HRA, LTA, income of minor child, etc.

- Allowance for children's/self-education

- Medical allowance

- Conveyance

- Loan interest on self-occupied house

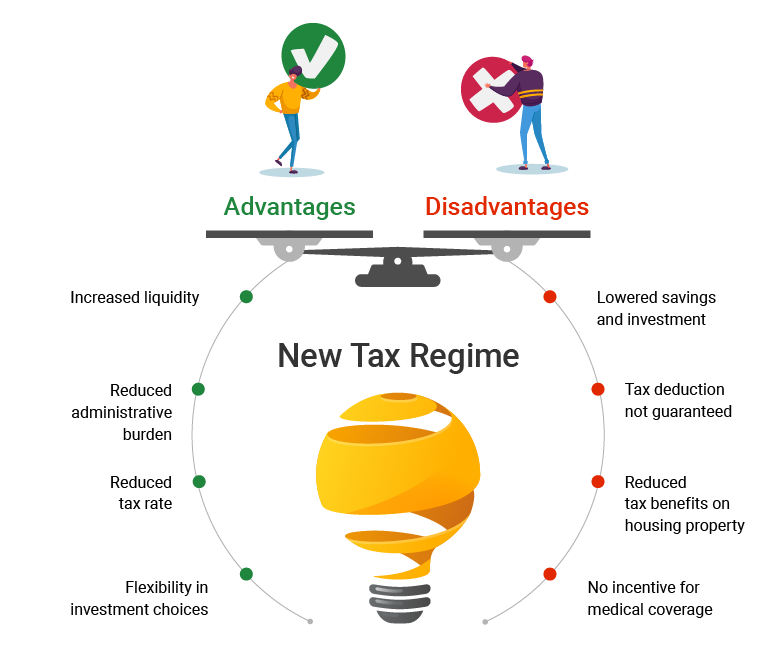

Advantages of the New Regime

Increased liquidity:

This is an apparent advantage of the new regime. People who opt for this regime don't have to make their investment decisions based on only the tax benefits associated with the instrument. Also, lock-in periods don't matter here! Instead, they would be guided by the long-term benefits of the entire investment cycle.

Reduced administrative burden:

In the old regime, the concerned employees were required to produce documentary proof for benefits like HRA, LTA, etc. In case an employee opts for the concessional tax regime, the proof would not be required since there are no exemptions or deductions. This results in reduced administrative burden for both the employer and employee.

Reduced tax rate:

The concessional tax regime aims to reduce the tax rate and could lead to more disposable income in the hands of individuals.

Flexibility in investment choices:

Since the focus on the taxpayer is not on tax-benefit-driven investments, there is a wider choice of instruments available to the individual.

Disadvantages of the New Regime

Lowered savings and investment:

Since there is no tax benefit, the new regime is likely to encourage high spending instead of saving and investing. Employees would be guided towards increasing their disposable income for the purpose of expenditure.

Tax deduction not guaranteed:

One needs to do a comparative analysis every year and see which of the schemes would be beneficial. Tax saving is not certain. It depends on the level of income and the kind of investments the individual has been making. A changeover may be required for those not happy with the new regime.

Reduced tax benefits on housing property:

Individuals with property loans may not find the new regime attractive since there is no tax benefit on housing-loan interest payments. Also, there is no tax benefit for loss due to the self-occupation of a property.

No incentive for medical coverage: Tax benefits provide an added motivation to individuals for obtaining medical coverage. But deductions for medical insurance or term insurance are not available in the new scheme.

The Tax Withholding Process

The circular released by the tax authorities lays down a simple process for withholding tax. Employees can choose the regime on the portal and intimate their employer. Accordingly, the employer will do the tax withholding based on the applicable tax rates of the concessional regime. In case the employee doesn't intimate the employer, then the withholding will be done as per the rates in the old regime.

Once an employee intimates the employer, there is no rollback during the fiscal year. But at the time of filing the return of income, it is possible to opt for a different scheme. A separate form (Form 10IE), prescribed by the Income Tax authorities, has to be used for this purpose. The chosen regime can be continued even if there is a change of employer.

In case an employee files the return opting for the concessional regime in a tax year, then the declaration on the payroll portal for all subsequent years should be for the same.

Do you wish to learn about the tax benefits of Covid ex gratia, retiral benefits, ESOPs, WFH rebates, donations, fuel reimbursement and more?

Watch the recording of the entire webinar